Understanding Seasonal Cash Flow Challenges for Established Businesses

Established businesses often operate within industries where demand fluctuates throughout the year, leading to pronounced seasonal cash flow challenges. Whether it’s a retail store bracing for the holiday rush, a landscaping service navigating the ebb and flow of summer projects, or a hospitality business gearing up for tourist season, these enterprises must expertly manage their finances to thrive during both peak and off-peak periods.

Seasonal cash flow gaps arise when revenue surges for a limited timeframe, but operational expenses such as payroll, inventory procurement, and facility maintenance remain constant year-round. This mismatch can create periods where cash reserves are strained, jeopardizing an otherwise solid business’s ability to meet its financial obligations. The challenge is not a lack of profitability but rather the timing of cash inflows and outflows.

Key Pain Points of Seasonal Cash Flow

- Inventory Management: Businesses must stock up in advance for busy seasons, tying up significant capital in inventory before sales are made.

- Payroll Commitments: Maintaining a skilled workforce, even during slower months, requires consistent payroll funding.

- Fixed Overheads: Expenses such as rent, utilities, and insurance persist regardless of revenue fluctuations.

- Unpredictable External Factors: Weather, economic shifts, or changing consumer preferences can exacerbate cash flow unpredictability.

These challenges underscore the importance of strategic financial planning for established businesses with seasonal cycles. Understanding and anticipating such cash flow patterns is essential for sustained growth and operational stability, paving the way for effective funding solutions like short-term loans tailored to these unique needs.

Benefits of Short-Term Loans in Managing Seasonal Fluctuations

Seasonal businesses, whether rooted in retail, hospitality, or agriculture, face unique financial challenges as their cash flow often surges and recedes with the changing seasons. These fluctuations can make it difficult to maintain operations, purchase inventory, or invest in marketing during off-peak months. This is where short-term loans from Grand Capital Group step in as a strategic financial solution, offering much-needed stability and flexibility for businesses navigating these cyclical patterns.

Immediate Access to Working Capital

One of the primary benefits of short-term loans is the immediate availability of funds. When a seasonal business anticipates a surge in demand—such as a retailer preparing for the holiday rush or a landscaping company gearing up for spring—having access to quick capital allows them to stock up on inventory, hire additional staff, or cover overhead expenses without delay. Grand Capital Group’s streamlined application process ensures that funds are accessible when timing is critical, minimizing disruptions and maximizing potential profit during peak periods.

Flexible Repayment Structures

Short-term loans are designed with flexibility in mind, which is essential for seasonal businesses whose revenue streams are not consistent year-round. Grand Capital Group offers tailored repayment schedules that align with a business’s income cycles, reducing the strain of large, inflexible monthly payments during slower months. This flexibility empowers business owners to focus on growth rather than worrying about cash flow gaps.

- Bridge Off-Season Gaps: Secure essential funding to cover rent, utilities, and payroll during quieter seasons.

- Seize New Opportunities: Quickly respond to emerging trends or market demands without waiting for cash reserves to build up.

By leveraging short-term loans from Grand Capital Group, seasonal businesses gain a reliable financial partner that understands their unique needs, helping them manage uncertainty and capitalize on every opportunity as the market shifts.

How Restaurants Leverage Short-Term Loans for Smooth Operations

For restaurants, the rhythm of business is often dictated by the ebb and flow of seasons. From bustling holiday crowds to quieter off-peak months, maintaining seamless operations requires strategic financial agility. Short-term loans from Grand Capital Group have emerged as a vital resource, empowering restaurant owners to bridge gaps, seize opportunities, and ensure consistent service excellence regardless of the season.

Managing Inventory and Supply Chain Demands

One of the foremost challenges restaurants face is managing unpredictable inventory requirements. Sudden influxes of diners—such as during holidays or festival periods—can put immense pressure on stock levels. With a short-term loan, restaurant managers can swiftly replenish ingredients, purchase specialty items, or bulk order non-perishable goods without straining their operating cash flow. This proactive approach helps prevent shortages and ensures that every customer receives a premium dining experience.

Addressing Staffing Fluctuations

Seasonal surges often necessitate hiring temporary staff or offering overtime to existing employees. Short-term funding provides the financial flexibility to cover increased payroll expenses during peak times. This not only supports optimal service levels but also enhances employee morale by ensuring timely compensation, which is crucial in the hospitality industry.

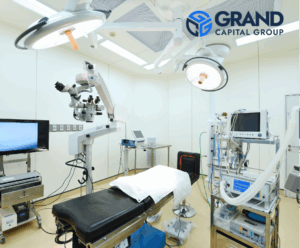

Enabling Timely Equipment Repairs and Upgrades

Unexpected equipment breakdowns can disrupt restaurant operations and diminish customer satisfaction. Access to fast, short-term financing allows owners to address urgent repairs or invest in necessary upgrades—such as new kitchen appliances or expanded seating—without delay. This agility helps restaurants remain competitive and responsive to market demands.

By leveraging short-term loans from Grand Capital Group, restaurants can navigate seasonal fluctuations with confidence, maintaining smooth operations and laying the groundwork for sustained growth.

Retail Stores and the Need for Flexible Business Funding

Retail stores operate in an environment defined by constant change. From shifting consumer preferences to fluctuating market trends, these businesses must remain agile to survive and thrive. One of the most significant challenges retail owners face is managing cash flow, particularly when navigating seasonal peaks and valleys. During high-demand periods such as the holiday season or back-to-school rush, inventory levels must soar to meet customer needs. Conversely, slower months require cost containment and careful financial planning. This cyclical nature underscores the vital importance of flexible business funding options tailored to the retail sector’s unique demands.

Traditional financing can be rigid, lengthy, and often ill-suited for the immediate needs of retail businesses. Banks and conventional lenders usually require substantial documentation, collateral, and time-consuming approval processes—factors that can hinder a retailer’s ability to act swiftly when opportunity knocks. In contrast, short-term loans offer a nimble alternative, allowing retail store owners to access the capital they need exactly when they need it most. This flexibility empowers retailers to:

- Stock up on inventory ahead of busy sales periods, ensuring shelves are always full.

- Seize timely business opportunities such as bulk purchasing discounts or unexpected supplier deals.

- Cover operational expenses during off-peak seasons to maintain staff and service levels.

For retail businesses, having access to responsive, short-term funding is not merely an advantage—it’s a necessity. As we explore how Grand Capital Group supports these needs, it becomes clear that flexible business funding is the backbone of seasonal success.

Supporting Manufacturers During Peak and Off-Peak Seasons

Manufacturers face unique financial challenges throughout the year, especially as demand fluctuates between peak and off-peak seasons. During high-demand periods, businesses must ramp up production, acquire additional raw materials, and sometimes expand their workforce to meet customer orders efficiently. Conversely, off-peak seasons often bring a slowdown in sales, leading to cash flow constraints that can impact ongoing operations and preparedness for the next surge in demand.

Short-term loans from Grand Capital Group offer manufacturers a strategic solution to these cyclical pressures. By providing quick access to working capital, these loans empower manufacturers to purchase inventory, cover payroll, and manage operational costs without disrupting business continuity. The flexibility of short-term financing ensures manufacturers can seize opportunities during peak seasons—such as taking on larger orders or negotiating discounts with suppliers for bulk purchases—without straining their existing financial resources.

Adapting Financial Strategies to Seasonal Needs

- Sustaining Inventory Levels: Short-term loans enable manufacturers to maintain optimal inventory levels in anticipation of heightened demand, ensuring production lines remain active and delivery timelines are met.

- Bridging Cash Flow Gaps: During slower months, these loans provide crucial liquidity, allowing manufacturers to cover fixed costs and avoid operational slowdowns.

- Investing in Growth: Access to immediate funds positions manufacturers to invest in new equipment or process improvements, enhancing their competitiveness regardless of the season.

With Grand Capital Group’s tailored short-term funding solutions, manufacturers gain the agility to respond proactively to seasonal market shifts, fostering stability and long-term growth.

Features of Short-Term Loans Offered by Grand Capital Group

For businesses navigating the cyclical nature of seasonal industries, access to flexible financing solutions can make all the difference. Grand Capital Group stands out by offering short-term loans specifically tailored to address the unique demands of seasonal enterprises. These financial products are not only designed with agility in mind but also come loaded with features that empower business owners to seize opportunities and weather unpredictable market shifts.

Flexible Loan Amounts

Grand Capital Group understands that every business’s funding needs are distinct. Whether you require a modest injection of capital to replenish inventory or a more substantial sum to ramp up operations during peak periods, the company offers a broad range of loan amounts. This flexibility ensures you receive precisely what your business demands—no more, no less—helping you avoid unnecessary debt while maximizing working capital.

Streamlined Application and Fast Approval

Time is often of the essence, especially when preparing for a busy season. Grand Capital Group’s application process is efficient and user-friendly, minimizing paperwork and expediting approvals. Most applicants receive decisions quickly, allowing them to secure funding when it matters most. This rapid turnaround gives seasonal businesses a competitive edge, ensuring they never miss out on timely opportunities.

Short Repayment Terms with Manageable Schedules

Short-term loans from Grand Capital Group feature repayment plans that align with the flow of seasonal revenue. Borrowers can expect manageable schedules that prevent cash flow disruptions, enabling them to focus on daily operations rather than financial strain. The transparent terms and absence of hidden fees further foster trust and long-term relationships.

With these borrower-centric features, Grand Capital Group’s short-term loans act as a reliable financial bridge, empowering seasonal businesses to thrive amid cyclical challenges and capitalize on every opportunity the busy season brings.

Tips for Selecting the Right Short-Term Loan Solution for Your Business

Securing the right short-term loan can make all the difference for businesses navigating seasonal fluctuations. The dynamic nature of seasonal enterprises demands tailored financial solutions, making it crucial to approach the selection process methodically. Understanding your unique needs and the array of options available will empower you to make informed decisions that foster growth and stability.

Evaluate Your Funding Requirements

Begin by assessing the specific financial challenges your business faces during high and low seasons. Identify the amount you need to borrow, the intended use of funds—such as inventory restocking, payroll, or marketing—and the ideal repayment timeline. This clarity streamlines loan selection and prevents over-borrowing, ensuring you only take on manageable commitments.

Compare Interest Rates and Fees

Interest rates and associated fees can vary significantly among lenders. Grand Capital Group, for instance, offers competitive rates tailored to small and seasonal businesses. Don’t just focus on the headline rate; scrutinize the annual percentage rate (APR), origination fees, and any potential penalties for late payments or early repayment. Transparent terms will help you avoid hidden costs that erode your profits.

Assess Flexibility and Repayment Terms

Flexible repayment structures are essential for seasonal ventures. Look for lenders who offer adaptable schedules that align with your business’s cash flow cycles. Some short-term loans provide options for daily, weekly, or monthly payments, giving you control over your financial commitments.

Review Lender Reputation and Support

Choose lenders with a proven track record of supporting small businesses. Grand Capital Group stands out for its responsive customer service and personalized guidance, helping you navigate the borrowing process confidently. Check reviews, testimonials, and industry credentials to ensure you partner with a trustworthy provider.

Selecting the right short-term loan is not merely about access to capital—it’s about forging a relationship that supports your business’s evolving needs. With careful consideration and a focus on transparency, you can secure funding that positions your seasonal business for sustained success.