Understanding SBA 7(a) Loans for Business Funding

Small businesses often face significant challenges when seeking the capital necessary to grow and thrive. The SBA 7(a) loan program stands out as a vital resource for entrepreneurs aiming to expand their ventures, purchase equipment, or manage working capital. Backed by the U.S. Small Business Administration, the SBA 7(a) loan is designed to make financing more accessible and affordable for businesses that might not qualify for conventional loans due to limited collateral, credit history, or other factors.

At its core, the SBA 7(a) loan program offers government-backed guarantees to approved lenders, effectively reducing their risk and encouraging them to provide much-needed funds to qualified small businesses. Loan amounts can range up to $5 million, providing flexibility for a wide array of business needs—from acquiring real estate and inventory to refinancing existing debt. Interest rates are competitive, and repayment terms are typically more generous than those found with traditional business loans, giving business owners the breathing room to invest in growth without undue financial strain.

Key Features of SBA 7(a) Loans

- Flexible Use of Funds: Whether the goal is to expand operations, purchase inventory, or finance equipment, the SBA 7(a) loan can adapt to diverse business objectives.

- Favorable Terms: Extended repayment periods—often up to 10 years for working capital or 25 years for real estate—help manage cash flow.

- Lower Down Payments: Compared to many conventional loans, SBA 7(a) loans often require less upfront capital, making them more accessible.

Understanding the foundational benefits and structure of SBA 7(a) loans is the first step for business owners considering smart, strategic funding solutions. The next section explores how Grand Capital Loans expertly navigates this process to empower business growth.

Key Benefits of SBA 7(a) Loans for Established Companies

For established businesses seeking to accelerate growth, the SBA 7(a) loan program stands out as a flexible and powerful financial solution. Grand Capital Loans leverages this program to empower companies with resources tailored to their specific expansion goals. Unlike conventional loans, SBA 7(a) loans offer unique advantages that directly address the needs of businesses ready to scale operations, invest in innovation, or strengthen market presence.

Unmatched Flexibility in Use of Funds

One of the most compelling attributes of SBA 7(a) loans is their exceptional versatility. Borrowers can allocate funds for a variety of purposes, including working capital, equipment purchases, real estate acquisition, or refinancing existing debt. This flexibility allows established businesses to respond dynamically to market opportunities, whether that means upgrading technology, expanding facilities, or hiring key personnel.

Favorable Loan Terms

SBA 7(a) loans are structured with business growth in mind. They offer longer repayment periods—often up to 10 years for working capital and 25 years for real estate—helping companies manage cash flow more effectively. Additionally, these loans often come with lower down payment requirements and competitive interest rates, making them accessible for businesses that want to conserve capital for strategic investments.

Support for Expansion and Stability

With the guidance of Grand Capital Loans, established companies gain a reliable financial partner to navigate the SBA process. The result is access to capital that not only funds expansion but also builds long-term stability, supporting sustained growth and resilience in today’s competitive landscape.

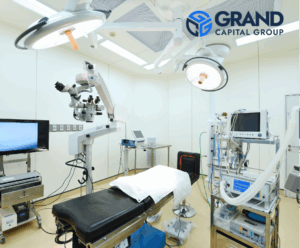

How Medical Businesses Gain from SBA 7(a) Loan Programs

The healthcare industry is uniquely dynamic, often requiring substantial capital investment to maintain competitiveness and deliver exceptional patient care. For medical businesses—ranging from private practices and dental offices to urgent care centers—the SBA 7(a) loan program represents a strategic financial solution tailored to support growth, modernization, and stability in an ever-evolving landscape.

Flexible Funding for Equipment and Expansion

Access to advanced medical equipment is vital for providing quality care and staying ahead in the sector. SBA 7(a) loans offer flexible funding options that empower healthcare providers to purchase or lease state-of-the-art diagnostic tools, surgical apparatus, and electronic health record systems. This not only enhances operational efficiency but also improves patient outcomes through the adoption of cutting-edge technology.

Working Capital for Operational Stability

Fluctuations in patient volume, changing reimbursement models, and evolving regulations can create financial uncertainty for medical businesses. SBA 7(a) loans provide the necessary working capital to navigate these challenges, ensuring that payroll, supply costs, and facility expenses are consistently managed. Having a reliable source of funds allows healthcare organizations to focus on delivering uninterrupted care, even during periods of economic volatility.

Facilitating Growth and Practice Acquisition

For practitioners aiming to expand their footprint—whether through opening new locations, acquiring an existing practice, or renovating current facilities—the SBA 7(a) program offers attractive terms and manageable repayment schedules. This enables medical entrepreneurs to seize growth opportunities without compromising their financial health.

By leveraging the advantages of SBA 7(a) loans, medical businesses can confidently pursue innovation, stability, and expansion, positioning themselves for long-term success in a highly competitive industry.

Retail Industry Growth Through Flexible SBA 7(a) Financing

The retail sector thrives on adaptability, innovation, and the ability to seize opportunities as they arise. However, retailers often encounter challenges when it comes to securing the capital necessary to fuel expansion, update inventory, or invest in new technology. This is where Grand Capital Loans steps in, providing robust support through flexible SBA 7(a) financing designed specifically to meet the evolving needs of retail businesses.

Empowering Retailers with Tailored Financing Solutions

SBA 7(a) loans, renowned for their versatility, serve as a vital resource for retailers aiming to grow or stabilize operations. Grand Capital Loans leverages the flexibility of these loans to help business owners access working capital, manage cash flow fluctuations, and fund growth initiatives. Whether a retailer is looking to open a new storefront, renovate an existing location, or diversify product offerings, SBA 7(a) financing offers terms and rates that accommodate diverse business models and ambitions.

Key Benefits of SBA 7(a) Loans for Retail Businesses

- Low Down Payments: Retailers can preserve cash flow with lower initial investments, making expansion more accessible.

- Longer Repayment Terms: Extended loan terms lead to manageable monthly payments, supporting sustainable growth.

- Working Capital Access: Funds can be used for inventory purchases, marketing campaigns, or technology upgrades, ensuring businesses remain competitive.

- Flexible Use of Funds: From refinancing debt to hiring new staff, retailers have the freedom to allocate resources where they are needed most.

By offering these adaptable financing options, Grand Capital Loans empowers retailers to capitalize on growth opportunities and navigate industry shifts with confidence, setting the stage for long-term success and resilience.

Advancing Construction Businesses with SBA 7(a) Loans

Construction businesses operate in a dynamic industry where access to reliable capital is critical for sustained growth and competitiveness. Grand Capital Loans recognizes the unique challenges construction companies face—fluctuating cash flow, high upfront material costs, and the need for skilled labor are just a few hurdles that can impede progress. Through the tailored support of SBA 7(a) loans, Grand Capital Loans empowers construction firms to overcome these obstacles and seize new opportunities for expansion.

Flexible Funding Solutions for Construction Needs

The SBA 7(a) loan is renowned for its versatility, making it an ideal financing solution for construction businesses at any stage of development. Whether you’re looking to purchase heavy equipment, invest in new technology, or increase working capital to handle multiple projects simultaneously, this loan program offers flexible terms and competitive interest rates. Grand Capital Loans works closely with business owners to design financing packages that align with their project timelines and cash flow cycles, minimizing financial strain while maximizing growth potential.

Expanding Project Capabilities and Market Reach

With the support of SBA 7(a) loans, construction companies can confidently bid on larger contracts, take on more complex projects, and expand their service offerings. The infusion of capital enables investment in skilled labor and advanced machinery, positioning businesses to deliver higher-quality results and meet evolving client demands. As a result, construction firms can accelerate their growth trajectory, increase profitability, and establish a strong foothold in competitive markets.

Through Grand Capital Loans’ expertise and commitment to client success, construction businesses gain the financial resources and guidance necessary to transform ambitious plans into tangible achievements—setting the stage for continued expansion and industry leadership.

Grand Capital Loans Expertise in SBA 7(a) Business Support

Grand Capital Loans stands at the forefront of business financing, offering a specialized focus on SBA 7(a) loans—a cornerstone solution for entrepreneurs seeking to grow or stabilize their companies. With years of dedicated industry experience, Grand Capital Loans has honed a deep understanding of the unique challenges and opportunities that small businesses face. This expertise translates into tailored guidance, ensuring that clients not only secure funding but also maximize the strategic advantages of the SBA 7(a) loan program.

At the heart of Grand Capital Loans’ approach is an unwavering commitment to client success. Their team of lending experts navigates the complexities of SBA 7(a) requirements with confidence, demystifying the process for business owners. By leveraging extensive knowledge of eligibility criteria, documentation, and industry best practices, Grand Capital Loans streamlines the application process, reducing the likelihood of delays and increasing approval rates. This meticulous attention to detail allows entrepreneurs to focus on what matters most—running and expanding their businesses.

Comprehensive Support Throughout the Loan Lifecycle

- Personalized Consultation: Each business receives a thorough evaluation to ensure the SBA 7(a) loan aligns with its specific growth goals.

- Application Mastery: Grand Capital Loans assists in assembling complete, compelling applications that meet all SBA requirements.

- Ongoing Partnership: Support extends beyond funding, with ongoing advice to help businesses leverage their loan for maximum impact.

This end-to-end guidance cements Grand Capital Loans as a trusted resource for entrepreneurs seeking not just financial assistance, but a partner invested in their long-term growth.

Choosing SBA 7(a) Loans for Long-Term Business Success

In today’s competitive business environment, securing the right financial support is pivotal for sustainable growth and long-term stability. SBA 7(a) loans, offered through lending partners like Grand Capital Loans, have emerged as a preferred financing solution for entrepreneurs aiming to establish, expand, or strengthen their businesses. These loans are backed by the U.S. Small Business Administration, ensuring more favorable terms and lower risk for both lenders and borrowers compared to traditional financing options.

What sets SBA 7(a) loans apart is their remarkable flexibility. Whether your business seeks to purchase commercial real estate, invest in equipment, refinance existing debt, or simply access working capital, this loan program caters to a wide range of needs. The extended repayment terms, often stretching up to 25 years for real estate and 10 years for other purposes, reduce monthly payment burdens and allow businesses to conserve cash flow for operational priorities and strategic investments.

Key Benefits of SBA 7(a) Loans

- Lower Down Payments: Compared to conventional loans, SBA 7(a) loans typically require smaller down payments, making them accessible to businesses with limited upfront capital.

- Competitive Interest Rates: The government guarantee enables lenders to offer interest rates that are often lower than those of unsecured business loans.

- Flexible Use of Funds: Funds can be used for a variety of business purposes, from buying inventory to acquiring another business.

By choosing an SBA 7(a) loan through Grand Capital Loans, business owners receive expert guidance and tailored solutions designed to support sustainable growth. This strategic approach not only fuels immediate expansion but also lays a solid foundation for long-term business success.